After reading yet another story on a “credit crisis” casualty, this time Bear Stearns, I was affronted enough to write the following letter to the editor:

To: letters@smh.com.au

Subject: Financial companies shouldn’t have their cake and eat it too.Another day, another debt laden company goes to the wall. The US Federal

Reserve steps in “to promote the orderly functioning of the financial system”.

Why couldn’t they step in during the good times, billion dollar profits and

million dollar bonuses “to promote the orderly functioning of the financial

system”? The industry decries regulation that would “prevent innovation” during

the good times but then they want bail outs when things turn sour. Natural

selection should be allowed to take care of the “innovators”. They made this

“bed”, they should “sleep” in it.

They published it but they made some small changes, mostly fixing my grammar and spelling:

Subject: Lopsided intervention

Another day, another debt-laden company goes to the wall. The US Federal

Reserve steps in “to promote the orderly functioning of the financial system”

(“Nervous traders fear worse to come”, March 17). Why couldn’t they step in

during the good times of billion-dollar profits and million-dollar bonuses to

promote the orderly functioning of the financial system? The industry decries

regulation that would “prevent innovation” during the good times but then they

want bail-outs when things turn sour. Natural selection should be allowed to

take care of the “innovators”. They made this bed, they should sleep in it.

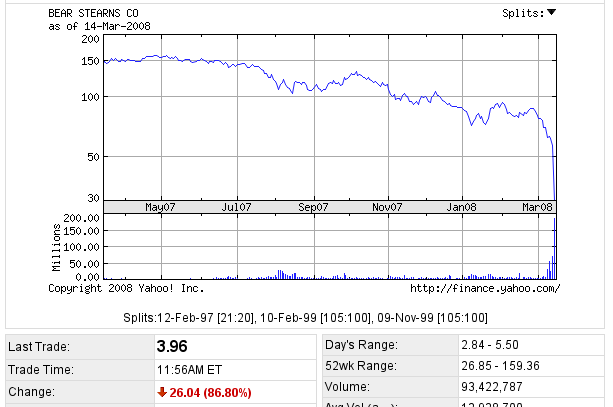

And the fallout from this one? Bear has been bought by JP Morgan Chase for around $2/share after trading near $160/share as little as a year ago. Ka-ching!

Source: Yahoo! Finance